Paying tax is an inevitable part of doing business. The more your income grows, the more tax you’re liable to pay. You’re rewarded for your success with a bigger tax bill. While we don’t want our clients to avoid paying tax or evade the tax department. We do want our clients to only pay the […]

Read about it

Although your tax return is not due for a few months yet, the end of the financial year is near. Get ahead now by preparing all the documents required for your 2021 tax return so you can get your tax done quickly and get any refund due to you in your bank! Income The Australian […]

Read about it

As part of the Federal Budget 2020-21, the government announced a loss carry back measure to encourage new investment and work with the temporary asset expensing measures also announced at the budget. The new law started on 1 January 2021. Eligible corporate entities that previously had an income tax liability in a relevant year, and […]

Read about it

The Federal Budget 2021-22 has many announcements and proposals aimed at economic recovery and includes investment in jobs, essential services, business incentives and tax cuts. Budget Highlights for Business Temporary full expensing measures extended until 30 June 2023 – eligible businesses can claim an immediate deduction for the total cost of depreciating assets. Temporary loss carry-back […]

Read about it

Are you interested in learning more about income splitting and how to minimise tax by apportioning income or profit between associated entities? Professional services firms frequently use income splitting – for example, medical, legal, financial or IT services firms. It’s a good way of reducing tax within the allowable provisions – so long as it […]

Read about it

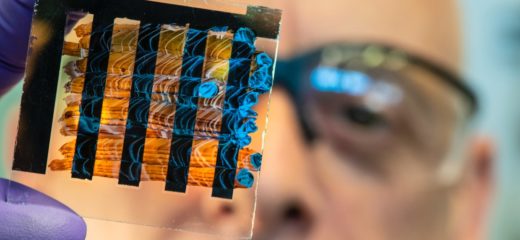

The Australian Government’s R&D tax incentive provides targeted offsets that aim to encourage more companies to engage in R&D, in order to contribute to a stronger economy. The incentive is designed to encourage research and development activities that companies may not otherwise do due to uncertain returns and risk. What’s involved? The R&DTI offers two […]

Read about it